Blogs

Recent Blog Posts

-

How to Create Customer Personas: 7 Simple Steps

How to Create Customer Personas: 7 Simple Steps -

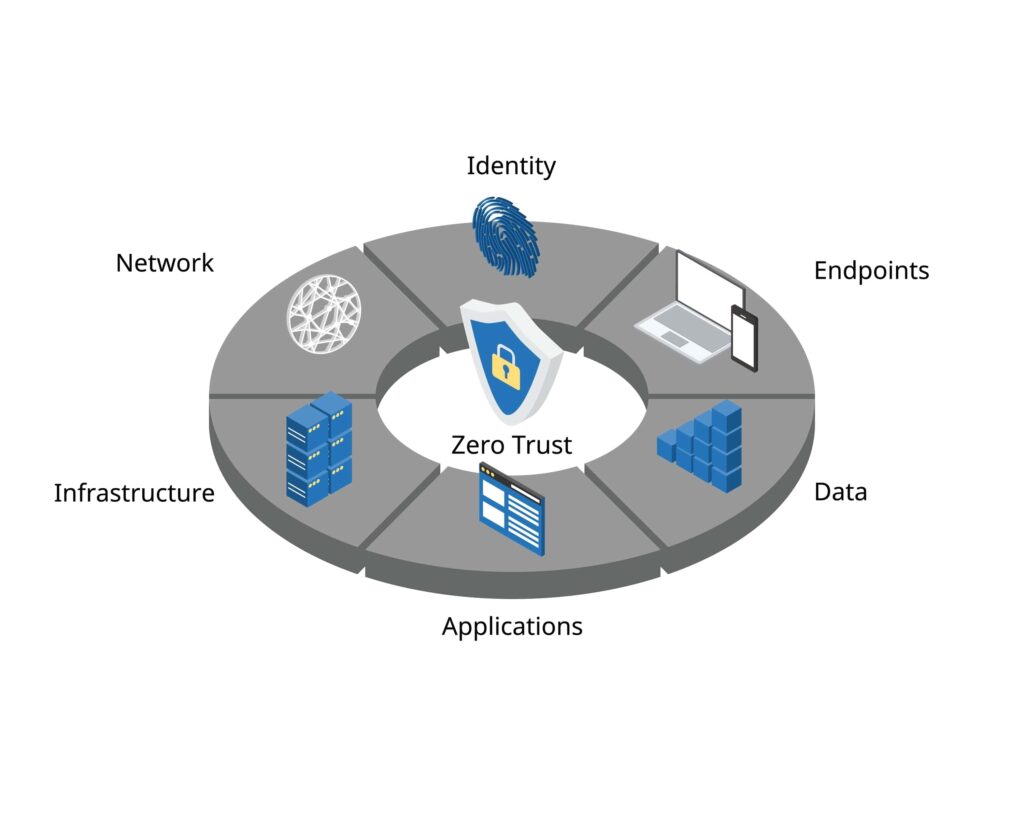

How to Implement Zero Trust Security: A Step-by-Step Guide

How to Implement Zero Trust Security: A Step-by-Step Guide -

Zero Trust vs. Traditional Security: Understanding the Differences for Your Business

Zero Trust vs. Traditional Security: Understanding the Differences for Your Business -

What is Zero Trust Security?

What is Zero Trust Security? -

What is Business Scenario Planning? A Beginner's Guide

What is Business Scenario Planning? A Beginner's Guide -

9 Organizational Change Management Strategies for Business Leaders

9 Organizational Change Management Strategies for Business Leaders -

AI Training for Employees: A Strategy for Business Growth

AI Training for Employees: A Strategy for Business Growth

Get in Touch